Mortgage Rates Hit Lows of Year Today

30 Year Jumbo $546,250 and up mid 3.5%’s—>

Edit: 30 Year Conforming not quite at the lows of the year. The week of 2/05/2015 they hit 3.59%.

Yesterday they hit 3.77%. Jumbo’s are at lows of year however.

http://www.mortgagenewsdaily.com/consumer_rates/516509.aspx

Oct 2 2015, 1:55PM

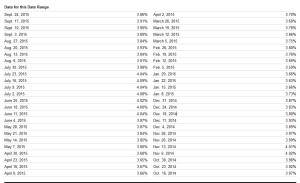

Mortgage rates had a wild day today. If you’ve spoken to a mortgage originator about rates any time in the past 24 hours, it’s important to understand just how immense the swings have been. Let’s start with the good news. The average conventional 30yr fixed rate quote thundered to its best levels in more than 5 months this morning, making it easily to 3.75% for almost any lender and even as low as 3.625% for quite a few lenders. This, after the big jobs report came in significantly weaker than expected.

The bad news is that the afternoon saw a fairly substantial reversal in the bond markets that underlie mortgage rates. When those trading levels begin losing ground, mortgage lenders are increasingly at risk of recalling rate sheets and sending out new, higher rates (aka “mid day reprice”). By the early afternoon, most lenders had pulled back their earlier, more aggressive offerings, leaving us with rates that are still better than yesterday’s, but not nearly as low as this morning’s.

The fact remains that the jobs report provided a compelling negative argument against a Fed rate hike and against general economic growth itself. Without a strong growth outlook, it will be hard for longer term rates to move higher, no matter what the Fed does with short term rates. There can still be plenty of volatility in the near-term though. That makes today’s 5-month lows yet another good opportunity to lock for those that aren’t interested in wading through the volatility. Doing so could prove beneficial, but only at the risk of being forced to accept a higher payment or fees if markets move against you. In general, the less time you have and the less flexibility on payment/costs, the more it makes sense to lock.

Loan Originator Perspective

“Today’s disappointing pay rolls report has helped bonds to continue to rally. We are at the best levels now since about April. The rate sheets I have seen have not passed along all the gains, which is pretty much standard operating procedure when we have a big rally. As always, if you are happy with current pricing, nothing wrong with locking. I however, favor floating all loans until Monday. This gives secondary departments time to see if the gains hold and gives rates time to allow Asian markets to respond to today’s report when they open on Sunday night.” –Victor Burek, Churchill Mortgage

“A dismal September jobs report boosted bonds today, as we neared levels we haven’t seen since last spring. I’ve been mentioning markets needed some defining motivation to break the range, and we now have it. Pricing improved significantly enough to actually lower rates, not just improve pricing. We’ll see how much carries over into next week, this report paints a dour economic picture for the US, it’s tempting to float, but sure could do worse than locking.” –Ted Rood, Senior Loan Originator

“The jobs report today was not a good one, a big miss some would say, yet rates only improved modestly. Part of the reason may be that we were at the best levels in some months prior to the report so there wasn’t much room to run. The lack of a strong rally today suggests there may not be much interest in lower rates from market participants. I think mortgage shoppers should seriously consider taking advantage of the best rates we’ve seen in the past few months and lock at this point.” –Jason B. Anker, Vice President- Loan Officer at Salem Five

“Mortgage Rates improved, again, today and more importantly we have broken through the bottom of a long term range. Sure, it could only be a small test and next week we rise back into the range, but I certainly believe that floating is worth the gamble at this point. Float, but as always, do so cautiously.” –Brent Borcherding, brentborcherding.com

Today’s Best-Execution Rates

- 30YR FIXED – 3.75%

- FHA/VA – 3.5%

- 15 YEAR FIXED – 3.125%

- 5 YEAR ARMS – 2.75 – 3.25% depending on the lender